My Credit History

When I got my first credit card, I knew that I wanted to eventually have an airline reward card. I always loved to travel and I knew that 1% cash back was not a great deal. However, after evaluating my non-existent credit history, I knew that I would be unable to get an airline card for at least a few years.

So, I built credit using a Capital One student card, which had a credit limit of $200, which I never came close to maxing. After using that card for nearly 2 years, paying it off without fail, an offer came through on my CreditKarma app – “Pre-Approved” for the Chase Southwest Airlines Card.

I went ahead and looked through the other card options, including United, American, and Delta, but were out of my reach. CreditKarma gave me low approval odds. I wasn’t a huge flyer on Southwest, but I figured I could try out the card, so I did.

Points started to accumulate quickly, especially when using the card for rent and utilities each month. I began to cash in my points for flights, and it turns out, I liked flying Southwest! I hadn’t been on the airline since I was a kid, but the free checked bags are always a nice perk. The barbaric group seating is a bit weird, but when traveling solo, I didn’t find this to be a big deal.

A few months later, I got another CreditKarma notification saying that I was pre-qualified for the Delta AMEX Blue card. I received the card at began using it exclusively so I could get the bonus points for spending $3000 in the first 3 months. I used the card for a while but ended up putting in a drawer and going back to the Southwest Airlines card, which I will explain in a moment.

I realized something though with receiving the Delta card – the only reason I got approved for it was because I had an existing business credit account with AMEX. My thought was if I could get approved for an “entry level” Citi credit card that it might fast track me for the American Airlines card.

On CreditKarma’s website, a (now non-existent) feature allowed a user to view credit card information and the average credit score, credit history, and age needed in order to obtain a specific card. The American Airlines card had an average age of 40 years old and an extensive credit history.

I applied for a Citi Double-Cash Back card and was accepted. Within 6 months, CreditKarma told me that I had great approval odds for the Citi AAdvantage Credit Card. I applied and was accepted! I started earning points as quickly as I could, as American had more routes than Southwest.

However, once I got the card and started flying with American Airlines, I realized that these 3 airline cards were vastly different from one another. The point systems and perks were vastly different which made me analyze the cards even more.

Here’s what I’ve found for each card

Delta SkyMiles Blue Card from AMEX

This card is the biggest loser of the group and includes virtually no benefits EXCEPT for the fact that there’s no annual fee. $1 = 1 Point on all transactions. There are no baggage perks or priority boarding.

In addition, I was never able to use points to buy a full flight. The point system was always seemed sky high! However, I was able to use points to get $50 off a flight that I took from Des Moines to RDU.

Finally, this card is has the lowest credit limit of any airline card that I own, $1500. I can’t even put my bills on this card without at least maxing it out.

Perhaps the solution was to get a higher tier card as I know some of the other Delta Airlines cards do offer free baggage and 2x the points at gas stations and restaurants.

If I were you, I would stay away from the Delta AMEX Blue card. I don’t use it unless I’m purchasing a flight from Delta, which is pretty rare.

Southwest Airlines Rapid Rewards Plus Card

The Southwest Airlines Rapid Rewards Plus Card has been the best card I own for domestic travel! The points seem to add up quickly and the point system makes it easy to redeem points. In addition, Southwest Airlines has a track record of being a great company to fly with – both with their stellar customer service and on-time performance!

Southwest Airlines will also run a monthly deal, making it easy to find low point value flights to make a quick getaway, sometimes as low as 5500 points! On an average round trip flight, I spend 17k points, which usually is flying from the east coast to Des Moines, IA (not a cheap route with any airline). However, I still feel like the 17k points is a fair trade compared to the AAdvantage point system, which I’ll dive into here shortly.

Southwest Airlines has a free bag policy, meaning each ticket holder gets 2 free checked bags plus the normal personal item and carry-on, which isn’t exclusive to the card. In addition, the card does NOT offer any priority boarding, simply the points.

The point system has a bit more benefit than the Delta card. On all transactions, $1 = 1 point. The additional perk is $1 = 2 points on Southwest Airlines purchases, in addition to the point value of rapid reward miles you get from booking the flight, and hotel purchases.

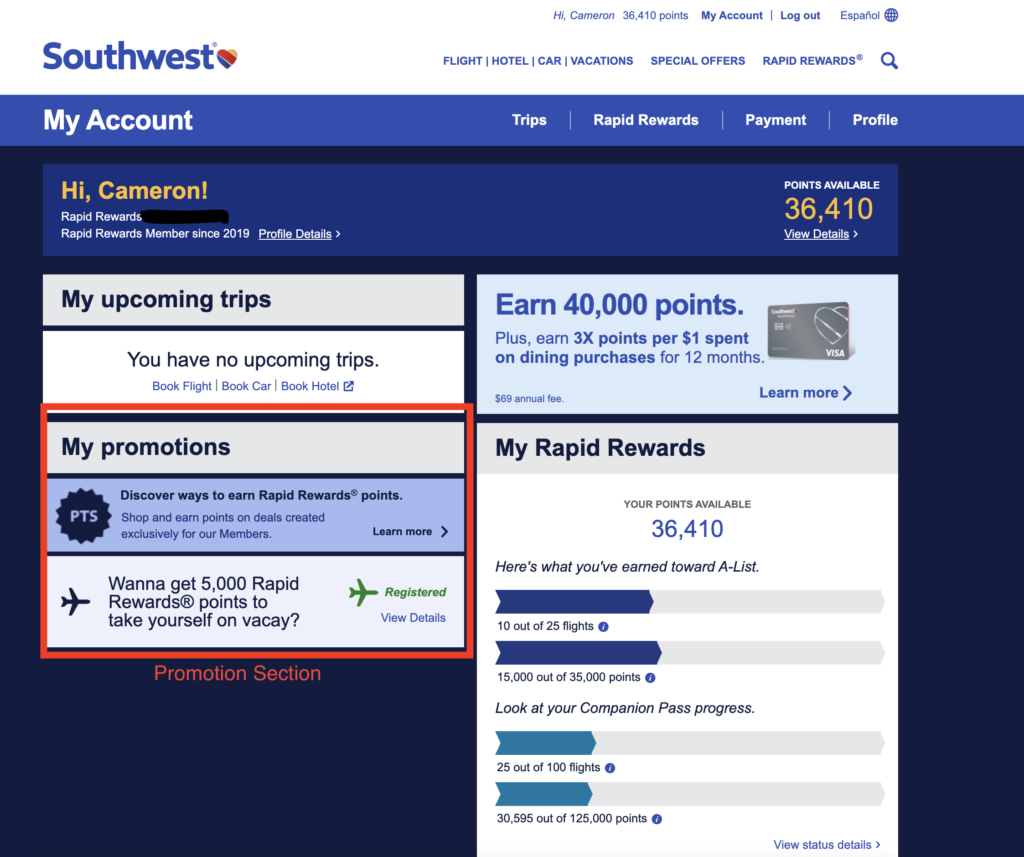

Lastly, I always check my RapidRewards account each month as sometimes it will allow you to register for extra deals. For example, during the pandemic, you could get up to 4x the points at grocery stores BUT only if you registered for the deal. I ended up with 5000 points at the end of this promotion only because I took the time to look at my account.

For Domestic flights, this is THE card to have. It’s $69 a year AND you get a bonus 3000 miles for renewing each year, which basically offsets the annual fee. Chase gave me a generous $8,000 credit limit when opening the card. I’ve never come close to the limit, which is nice for my credit report.

American Airlines AAdvantage Platinum Card from Citi

Right off the bat, this isn’t a great card for domestic flights. The point system is inflated compared to the Southwest Airlines card and it’s not much easier to earn points compared to the Southwest Card – HOWEVER, I have found it to be a useful card as it does seem to have good point values for international travel.

First, there is a yearly fee with the card of $99 which is waived for the first 12 months. You can earn up to 65k points for spending $2,500 in the first 3 months, which is a great bonus. You do get a free checked bag on domestic flights which includes up to 4 travel companions, which is a great perk. You also get a more priority boarding process, boarding with group 5 main cabin rather than group 6 or 7.

The point system is fairly similar to the other 2 cards with the base being $1 = 1 miles. However, with the AAdvantage card, you also get 2x points at gas stations and restaurants. With gas prices rising, this is a nice perk over the SWA card.

Traveling domestically, I’ve concluded that Southwest might be the best option, especially with some of the deals that they run (seriously, 5k points round trip if you play your cards right). With AA, I’ve not been able to find too many domestic “deals” under 15k points. However, this shouldn’t come as a huge surprise as it’s a slightly inflated point value.

For me to fly from Lynchburg, VA to Des Moines, IA it will cost a minimum of 30k points roundtrip. If I fly out of Raleigh-Durham international, I can get this down to 15k-20k, roughly the same price as Southwest Airlines. Another difference between the SWA and AA point system is that Southwest Airlines points directly correlate with the dollar amount of the ticket. American Airlines tends to follow a more blanket approach, without a real correlation of the price.

However, 30k points can get you to some pretty far places with American Airlines. 30k round trip can get you to many Latin American destinations. Additionally, for 50k points, you can fly in the international business class, which includes lie-flat seats, perfect for overnight long-haul flights.

The American Airlines credit card right off the bat gave me a $5,000 credit limit, making it easy to pay bills without hitting the ceiling unlike the Delta card, meaning you can pile on the points!

Conclusion

Stay away from the Delta Blue AMEX card. It’s worthless. Perhaps one of the other delta cards are better. Southwest Airlines, in my research, has better point systems, making it easier to save and buy flights, especially for fun trips. AA makes international trips a bit easier if you are willing to save the points but SWA seems to beat AA in domestic flight point value.

ieoOkxsrSGBc

Comment awaiting moderation.